Calculate how much commission you can earn by refinancing through mortgage brokers on FairBroker®

*Conditions Apply

1. Results from the calculator are an approximate estimation. Actual commission earned by mortgage broker is calculated and submitted by individual mortgage brokers on deal offer

2. Mortgage Broker commission is calculated at 0.65% of loan amount

3. Broker fee is based on current service fee for Refinance mortgage for PAYG customers

FairBroker® platform is user-friendly and very simple to use. It takes only few minutes to submit details and get great offers.

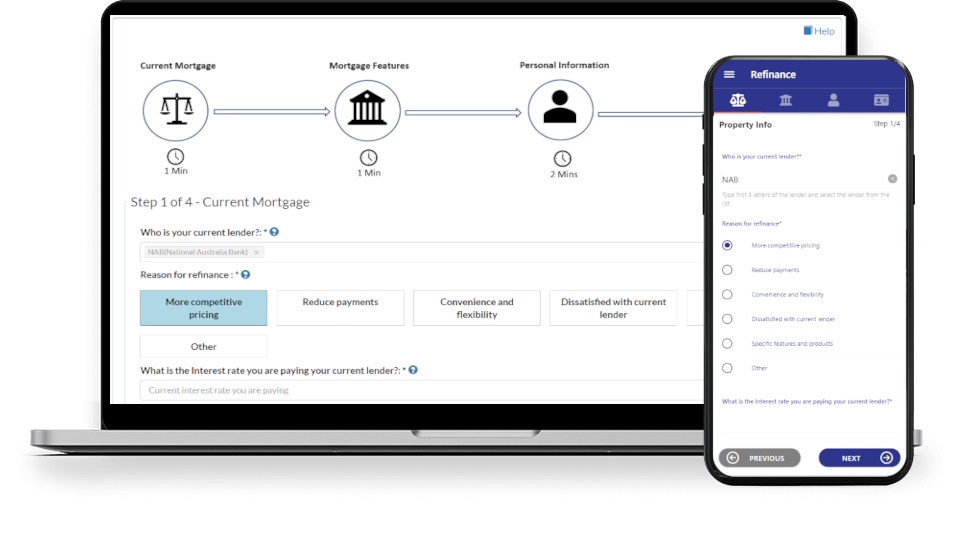

Fill out a simple form and tell us what you are looking for

First step is for us to understand your current situation, what are your requirements. This we acheive by taking you through a set of simple questions. We have designed our questions to ensure you have to answer them only once. This will enable mortgage brokers to precisely understand your current situation and your requirements to ensure a tailor made deal is offered to you.

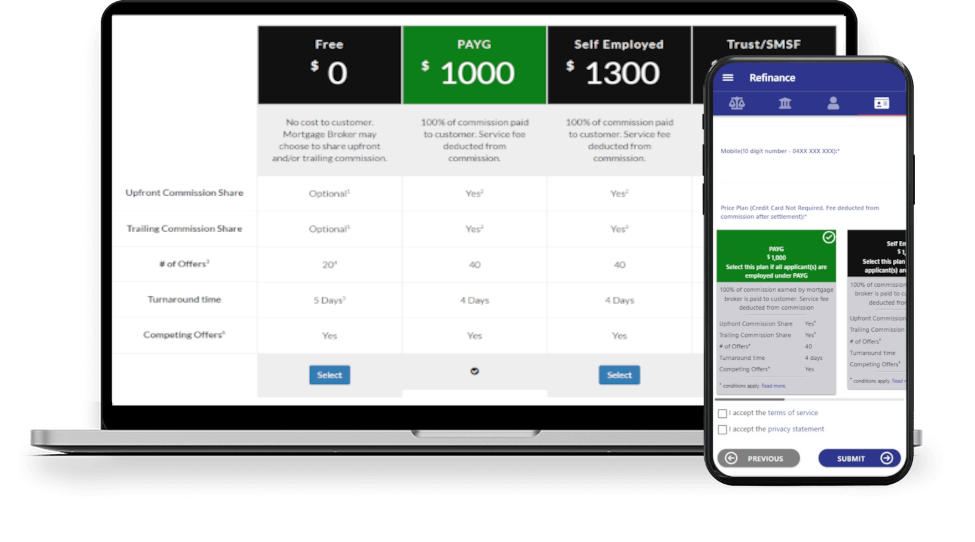

Select Price Plan

You have range of price plan options to select from Free to Fee for Service. Ensure you read the terms of service and select the most appropriate option to match your situation.

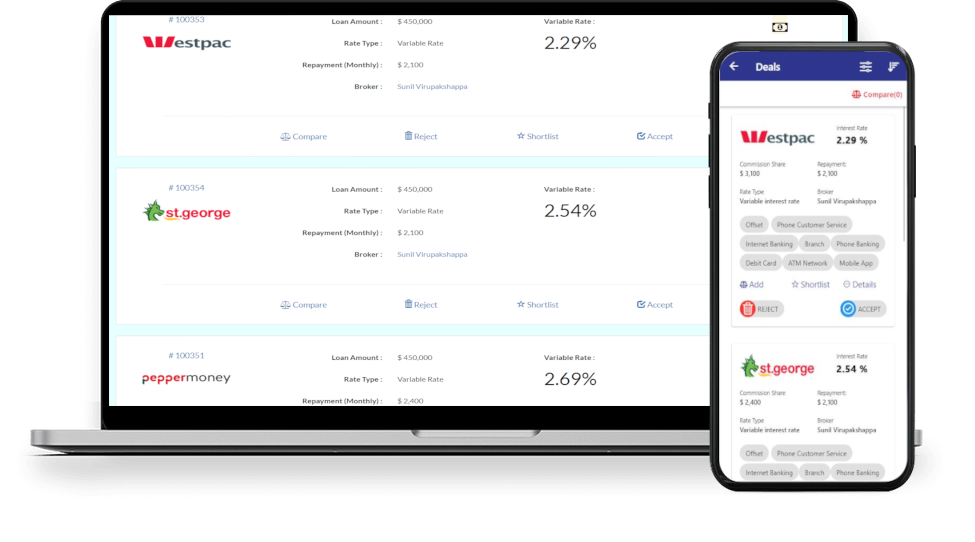

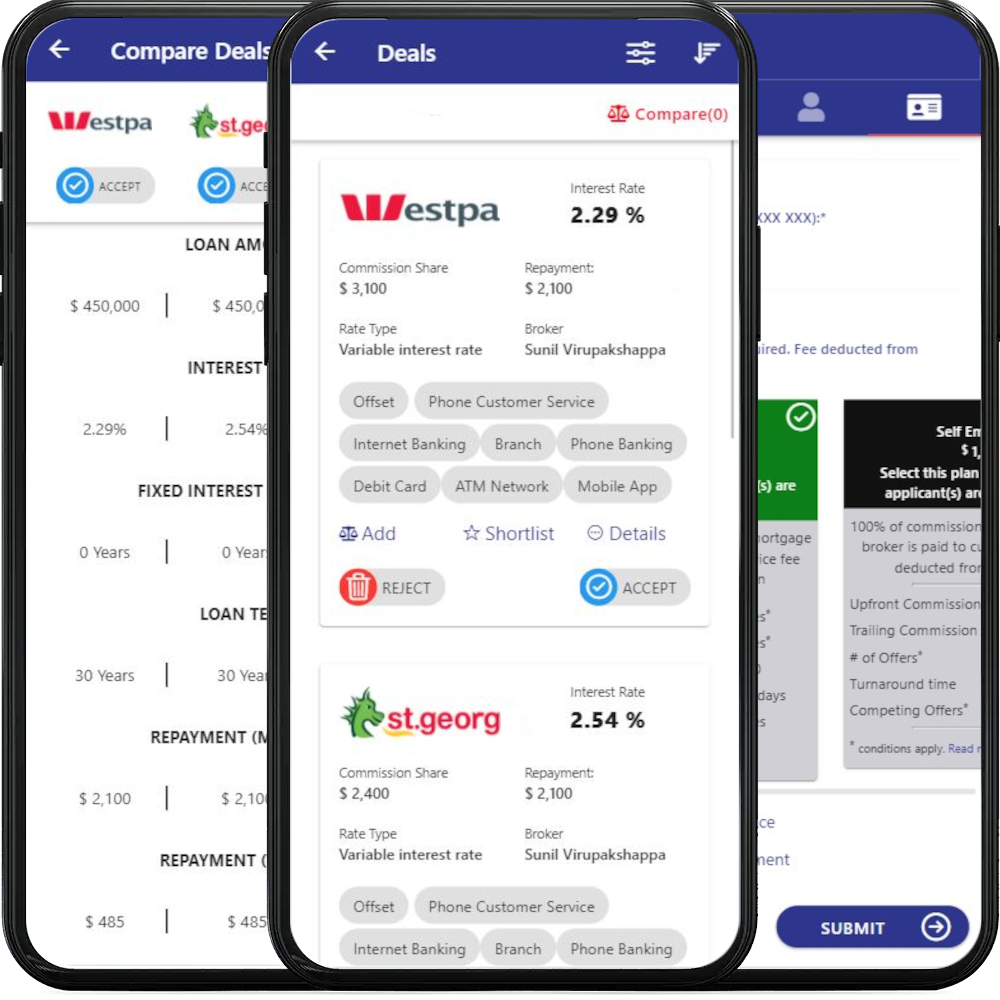

Review Offers

You will now receive range of attractive offers. You can sort on date, interest rate, repayment amount etc. Review and understand the details of offers

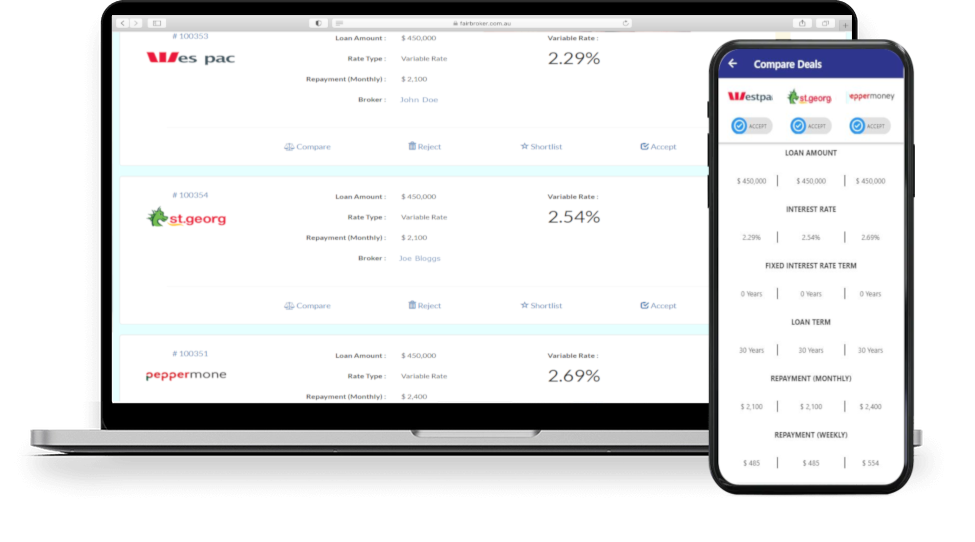

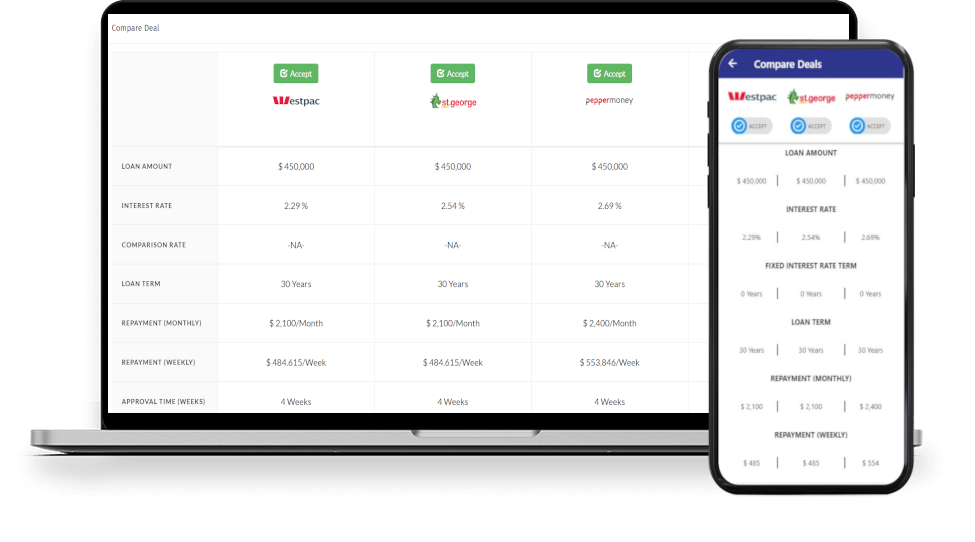

Compare Offers

You can also compare mortgage offers side by side using advanced compare functionality on the platform. This lists mortgage offers side by side for easy comparison.

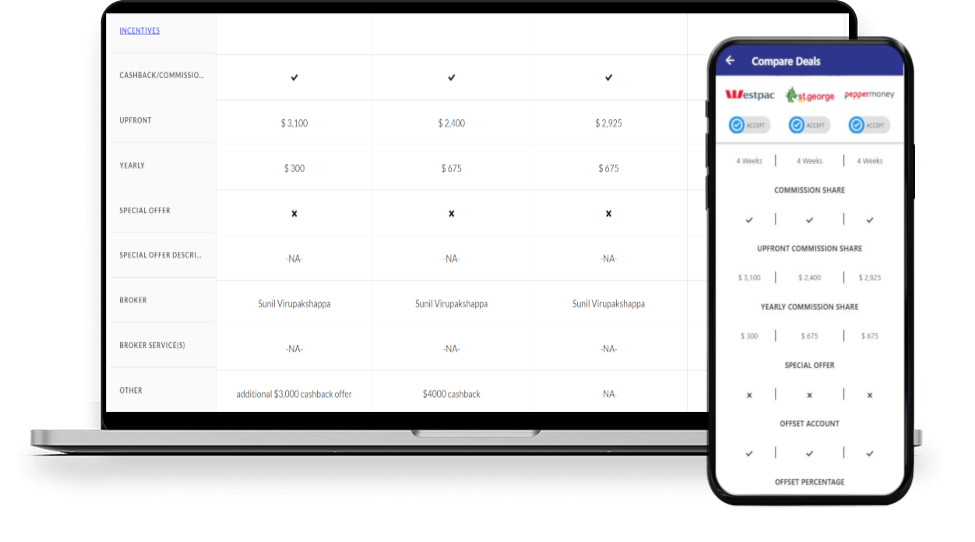

Review Incentives

Carefully review incentives offered with each offers. In a Fee for Service plan, a mortgage broker on the platform is obligated to share 100% of commission received by the lender to you. Each lender pays different commission rate. Review and compare the commission share amount with other incentives such as cash back offers etc.

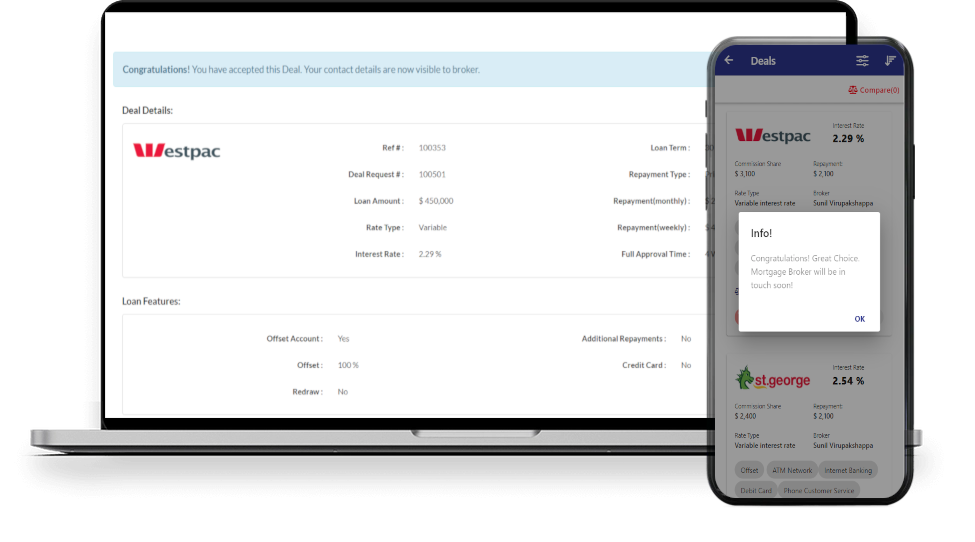

Select Offer

After reviewing the mortgage offers, select the most appropriate offer. Once you select an offer, the mortgage broker who offered the deal is notified and your contact details shared with the winning mortgage broker.

Find deals on the GO with FairBroker® mobile app

FairBroker® mobile app, available for Android and iOS platforms allows you to publish your details and seek mortgage brokers to offer deals. You can view deals, compare deals and incentives, communicate with mortgage broker using our mobile app. Our app is simple, extremely user-friendly and allows you to be in control on the GO.

Through our Mortgage Brokers, we have access to mortgage products from 75+ lenders

FairBroker® is built with bank grade security

At FairBroker®, we take security and privacy seriously.Your personal and contact details are stored on our secure servers located in Australia. FairBroker® uses bank grade security algorithms and infrastructure to protect your data. We follow and adhere to data privacy laws to ensure your data is safe and protected.

On FairBroker® your contact details are never shown to mortgage brokers or lenders until you accept a mortgage offer from a mortgage broker. You own your data, and we only use to for providing the intended service.

Price Plans

Our plans are currently designed to cater to customers who are looking to refinance their mortgage. We will soon be expanding our offer and design plans for new owner occupier and investment mortgages

FREE

Free plan with no obligation for mortgage brokers to share commission with borrower

$0

- Competing offers

- Loan amount > $0

- Upfront commission share at discretion of mortgage broker

PAYG

Suitable when all the mortgage applicants are on PAYG employment. Guranteed commission share.

$1,500

- Competing offers

- Loan amount > $300,000

- 100% of mortgage broker upfront commission shared with mortgage borrower

SELF EMPLOYED

Suitable when one or more mortgage applicant(s) is self employed. Guranteed commission share.

$1,800

- Competing offers

- Loan amount > $400,000

- 100% of mortgage broker upfront commission shared with mortgage borrower

SMSF/COMPANY

Suitable for SMSF or Company type mortgage applicants. Guranteed commission share.

$2,500

- Competing offers

- Loan amount > $500,000

- 100% of mortgage broker upfront commission shared with mortgage borrower

* Conditions Apply

1. The service fee is deducted from the lender commission paid to mortgage broker

2. 100% of the mortgage broker upfront commission share is calculated by mortgage broker for each deal offered by mortgage broker. The mortgage broker share may differ from commission given by lender as a result of fees and charges associated with aggregator and other relevant intermediary fees between mortgage broker and lender

3. Mortgage Brokers will deal directly with customers with regards to commission share and mortgage broker fees for service

4. Please read Terms and Conditions for further details

FAQ

General

Is there any cost associated with FairBroker® platform?

There is no upfront cost associated with FairBroker platform. The customer has the choice to get 100% of the commission earned by mortgage broker by opting for one of the 'Fee for Service' plans. In 'Free' plan, the mortgage broker can choose either to share or not share commission earned.

I am already working with a mortgage broker who informs me that he looks at a wide panel of lenders before shortlisting the lowest rate. How can FairBroker® platform be better?

Most of the brokers are affiliated to an aggregator. An aggregator is a software provider who funnels mortgage brokers application to a few lenders who are registered with the aggregator. There is not a single aggregator in Australia who has all the lenders and their products on their panel. Even if an aggregator claims to have 35 lenders on their panel, the mortgage broker may not have accreditation to process mortgage applications with all the 35 lenders. As a standard guideline, Mortgage brokers are not affiliated with more than one aggregator. These restrictions limit the mortgage brokers ability to get you the best deal because they do not have access to all the products from all the lenders in Australia. You must ask 3 questions to your mortgage broker. Productivity Commission has found some disturbing facts. Productivity Commission has found that incentives offered by mortgage providers to mortgage brokers have resulted in certain mortgage products being recommended even when the mortgage product is not suitable for consumer situation. Read more on our blog to find out if a mortgage broker can get the best mortgage deal.

There are many websites/portals who already compare mortgages. How is FairBroker® different?

The websites/portals compare only the mortgage products from lenders who pay them. They do not perform a comprehensive analysis of customer's needs before recommending a mortgage product from the limited set of mortgage products on their website. As a result, the rate you see in comparison result before applying will change when final approval is given. Additionally, they require you to submit an application for each lender. The lender will assess your application and check credit score before finalising the rate that they can offer, which is different from the rate that they showed you when you applied.Read more on our blog to find out how to get unbiased mortgage advice.

Does requesting deal on FairBroker® platform impact my credit score?

No. Credit score is impacted when repeated credit check is performed. We do not perform credit check nor allow mortgage brokers to perform credit check on you. Once you select a deal offer, it is upto the lender to follow their procedure and they may perform a credit check after obtaining consent from you. Read more on our blog to find out if credit score is impacted when mortgage shopping

Why do FairBroker® platform need my personal information?

The borrowing capacity and the interest rate that a lender can offer is dependent on the risk involved in lending. A mortgage broker will be able to make informed risk assessment and decision by looking at your information and provide competitive deal offers. Providing more and accurate information in the deal request will enable mortgage broker to understand your situation better and provide competitive deal offers. Read more on our blog to understand how who can see your personal information and how FairBroker® maintains your personal information.

Is my information secure on FairBroker® platform?

Yes. Please be assured that your information is secure with us and we comply with all the rules of the land. Your name and contact details are visible to a mortgage broker only after a deal offer given by a mortgage broker is accepted by you.

I do not have all the information. How can I create a deal request on FairBroker® platform?

There is the minimum information that we need before we publish your deal request. As long as you have the minimum information required, you can request a deal. Please note, the more information you provide, the mortgage broker will be able to better match the offer to your situation.

My credit history/score is very poor. Will I still get a deal on FairBroker® platform?

The best way to find an answer to your question is to create a deal request. On FairBroker® platform you always get you the best mortgage deal available in the market that matches your situation.

I am a sole trader, can I get a mortgage deal on FairBroker® platform?

Yes! On FairBroker® platform, there are mortgage brokers who specialise in offering best mortgage deals to sole traders. Create a deal request on FairBroker® platform and find the best mortgage deal.

Why will a mortgage broker come on FairBroker® platform to give me deal?

Mortgage brokers get paid by the lenders for selling their mortgage products. Mortgage brokers are always interested in increasing their business volume and keen to sell their service. FairBroker® platform provides the mortgage brokers with a level playing field to compete with other mortgage brokers and an opportunity to increase their business. Read more on our blog to understand how FairBroker® platform helps you find the best mortgage deal.

How can I be sure that FairBroker® is not biased towards a lender or mortgage broker?

FairBroker® is unbiased and an open platform where every single mortgage broker on the platform gets equal opportunity to sell their offering to interested customers. We do not charge a fee to Mortgage Broker to access FairBroker® platform to ensure you can trust us to be unbiased. Since we do not charge a fee any mortgage broker who has access to best mortgage deal can come on FairBroker® platform and offer the best mortgage deal.

Is FairBroker® a mortgage broker?

No. We are not a mortgage broker. We aim to create a level playing field for all mortgage brokers and finance products to enable consumers to choose the best of the lot. We are a technology company that has created a marketplace for consumers to find the best mortgage through competing mortgage brokers. When you create a Deal Request on FairBroker and accept Deal, you will work directly with the mortgage broker who offered the Deal. Read more on our blog to understand how FairBroker® platform helps you find the best mortgage deal.

What happens after I accept a deal offer?

Once a deal offer is accepted, we will share your contact information with the mortgage broker whose deal offer you have accepted. The mortgage broker will then contact you to collect documentary evidence and sign deal documents.

Will a deal offered and accepted by me ever be not honoured?

This is a rare circumstance.This can happen in the following situation:

- You cannot provide documentation evidence to support information provided in your deal request

- Any change in macro economic scenario or a change in lending criteria by lenders

Can I negotiate further after accepting a deal on FairBroker® platform?

Absolutely! FairBroker® platform's role is to ensure you found the best mortgage broker who can offer you the best mortgage deal. You can negotiate further with the shortlisted mortgage broker to get a better deal. We doubt the occurrence of such a situation unless you have not provided enough information in your deal request. A mortgage broker would have offered the best deal looking at the information available in your deal request. If you have not provided enough information in the deal request, you may be losing out.

Testimonials

"I had a pleasant experience with FairBroker® where I was able to get multiple quotes from 4-5 Brokers with in 24 hours. I had a good choice of offers to pick from across a range of lenders. The broker promptly contacted me after I accepted one of the offers and from there on the process to settlement was smooth. With FairBroker® you actually get to choose from quotes across Brokers and you decide which broker ad lender to go with."

Mahesh P Borrower

"FairBroker® is a great platform for a qualified Mortgage Broker like myself and gives us a great platform to showcase our skills and get the best for the client as we all work in Best Interest for the client. Working with the team of FairBroker® has been very pleasing and they have been very patient to listen to our suggestions and incorporate them within a short span of time."

Harish Madakshira Mortgage Broker

Our Blog

How to shop around for a mortgage?

Mortgage is one of the most important financial commitment. While every one wants best mortgage deal, it is not an easy task to find one.

3 Questions that you must ask your mortgage broker

Mortgage brokers are vital to vibrant mortgage industry. Mortgage brokers create competition between lenders. Unfortunately, some uncomfortable...

Responsible Lending Obligations

Responsible lending obligations are set to be dropped from the National Consumer Credit Protection Act 2009(NCCP). The government is working on dropping...

Is it FREE to use FairBroker®?

FairBroker® is free to use and will remain free to use forever to borrowers. This is a conscious decision to ensure an already burdened borrower with conflicted..

Commission share and cashback offers with Mortgage

On FairBroker®, you can get mortgage offers with attractive commission share and cashback. FairBroker® platform creates competition between...

Are you considering using a mortgage broker? Is that the right decision? Are they better than banks? Read more to find out.

Can a mortgage broker get best mortgage deal?

Mortgage is one of the biggest financial decision. Can mortgage broker help you get a best mortgage deal? Read more to find out.

How to find best mortgage deal?

FairBroker® platform allows consumer to find best mortgage broker or lender with access to best mortgage deal to meet consumer requirements.

Read more on FairBroker® blog. There are blog posts to help you make best decision when it comes to mortgage.